To fellow crypto builders & investors.

Congratulations on joining the dMBA ! 🎓

I've moved beyond Cercle ⭕️ DAO's banner, and I am now taking the program to the wider crypto community.

Together, we’re on a mission to make venture funding and building more easily accessible to the crypto world.

Through various experimentations involving Web3 tech, Cercle DAO has been striving to build a clearer value proposition. I haven’t abandoned the project, and I’m convinced that this structure will play a fundamental role in the future.

My own strategic project focuses on supporting startups that make the global financial system more accessible, transparent and positively impactful.

From now on, I will be building the dMBA in public, and experimenting it directly on myself. My hope is that the program will serve as a laboratory to support the emergence of a new generation of fund managers and company builders.

At the same time, I'm hoping to build bridges and find mutual learning opportunities with established VC professionals to advance this cause.

The need for a paradigm shift in financial sovereignty and education is burning. Let's spread this message out there and make it happen : welcome to the dMBA’s Research Analyst Track!

Before we dive in, don’t forget to subscribe below to receive future updates : in a not too distant future, the dMBA might also encompass senior, partner and manager tracks … 😇

Let’s talk about valuation.

Why it matters ?

When a professional investor considers acquiring equity in a startup or stake in a project via tokens, he (she) needs to evaluate the value of the company / project and the potential return on investment. The same approach can also assist founders and CFO’s in making capital budgeting or operating expenditure decisions.

Who’s involved ?

Valuation requires a deep understanding of a company / project’s fundamentals (cash flows, market size, competition, growth potential), as well as the development of financial models that typically fall into the Research Analyst’s responsibility in a VC fund. His (her) role with this work is to support the senior members who make the final investment decisions.

What about crypto ?

As we will see, the range of methodologies applicable to value an asset largely depend on its intrinsic characteristics : does it generate any cash flow (yield, dividends) ? Is it scarce ? Is it widely used and accepted in the ecosystem ? There isn’t a one-size-fits-all approach for valuing crypto tokens !

Where to start ?

You may already have heard of Professor Aswath Damodaran from NYU Stern School of Business, and world-renowned expert in valuation. But did you know that the majority of his teaching material - including slides, class recording & tests - were available for free on his website ? A dMBA precursor ! 😇

Of course, lots of articles and pre-baked models can be found everywhere on the same topic. Rather than rushing headlong into spreadsheets and formulas, let’s dive into Damodaran’s approach and understand if / how we can transpose it to crypto.

The purpose of the dMBA is not limited to documenting my own journey, building and bootstrapping the curriculum for myself. We’re also laying the foundations of the first open-source business education graph, to serve as a reference for crypto investors and builders alike. Start sharing your own insights and comments below !

Premises

A bold statement

What striked me the most in Damodaran’s course introduction is his uncompromising, brutally honest take on a field that he has been teaching for several decades :

Most people don't believe in valuations, including those who do valuation for a living. All valuations are biased - the only question that is really relevant is the origin and size of this bias.

Because of this, a good valuation is more about the story, than about the numbers.

Get your parachute ready, lemmings !

So, what’s the whole point of aligning an arsenal of mathematical warfare to build valuation models, that are supposedly neither accurate, nor impartial ? As Damodaran puts it :

Valuation is a necessary antidote to the "they must know something that you don't" syndrome : the 7 most deadly words in investing.

A valuation model is a parachute any investor can deploy at the very last minute, that gives him (her) a chance to avoid falling straight into FOMO.

While a majority of market participants often like to jump from the same cliff, more often than not it’s simply too late until they realize they’re on the wrong side of a trade.

Been following a few crypto narratives over the past few years ? Must sound familiar, then …

Inefficiencies, everywhere

In a perfectly efficient market, the price of an asset is the best estimate of its value. The purpose of models is then to justify this value.

Valuation is the process of determining the value of an asset or business. The use of a valuation model to drive an investment decisions is based upon 2 assumptions:

Markets are inefficient and make mistakes in assessing value.

Different models take different type of inefficiencies into account, and different ways for the markets to correct them over time.

The 3 approaches to valuation

The intrinsic value approach

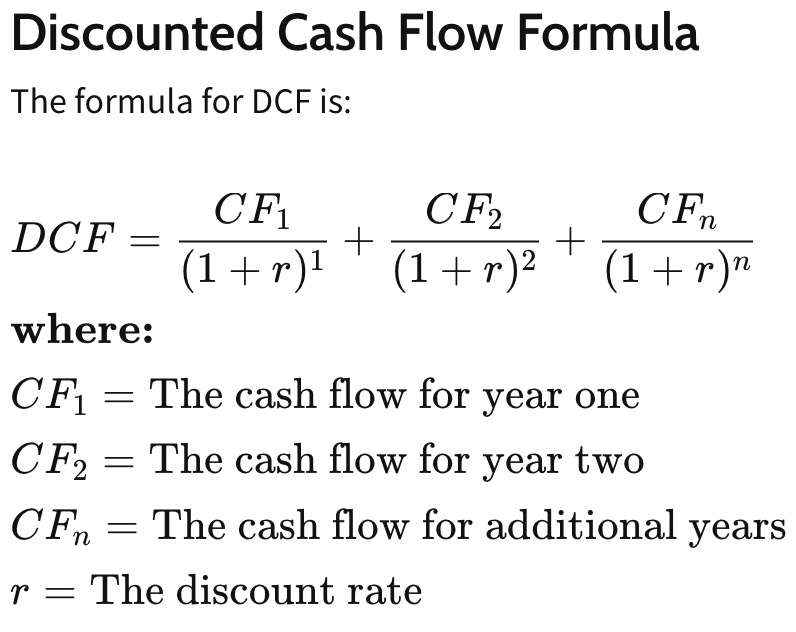

Also called Discounted Cash Flow valuation (DCF), this method estimates the present value of a business or an asset’s expected future cash flows.

The assumption behind this, is that every asset has an intrinsic value that can be estimated based on its growth and risk outlook.

Key inputs to a DCF valuation model include :

The length of an asset’s life (however many years the cash flows are expected to occur).

The projected cash flows during each period (typically reflecting the annual rate of growth).

The discount rate to apply to get present value (typically reflecting the risks associated with the investment = the cost of capital raised from or distributed to shareholders during each period, that justifies the cost of operation).

A great example of how such a model works can be found here.

But, if there’s one lesson to learn, it’s that intrinsically valuing an asset or business is a complex exercise. It requires a deep understanding of its fundamentals, which can be equally rewarding if you manage to take a step back and ignore the market’s noise for a minute.

The relative value approach (aka pricing)

This method involves comparing the value of an asset or business to similar assets or businesses, and determining its “fair” price based on other market prices or valuation multiples.

It’s based on the assumption that the intrinsic value of an asset can’t be estimated based in its sole fundamental characteristics : it’s just whatever the market is willing to pay for it.

Key inputs to a relative valuation model include :

An identical or comparable asset or group of assets.

A standardized way of measuring and comparing value between them.

Alternatively, variables that you can use to check the main differences.

Although relative valuation is, on paper, less complex than DCF valuation, it’s much more reliant on the general market sentiment, and therefore prone to short term and rapid fluctuations.

Despite the fact that the fundamentals of decentralized protocols are transparently exposed on the blockchain, this effect remains the main driver of crypto volatility in the current market.

The contingent claim approach (aka option pricing)

This last approach allows investors to come up with an estimation for assets whose value is otherwise too difficult to determine using any of the previous 2 methods.

For now, let’s bear in mind that options derive their value from an underlying asset : this value will materialize only if the price of the underlying asset becomes greater (or lesser) than an exercise price specified upon creation of the option contract, and before the contract expires.

Takeaways for crypto

Damodaran’s course intro states that currencies and collectibles can't be valued intrinsically, but only priced against other currencies or collectibles based upon their relative purchasing power, degree of acceptance, scarcity and desirability.

More specifically, in his latest blog post on the valuation of Bitcoin and crypto (January 2021), he explains his view that Bitcoin can not be classified as :

An asset - because it doesn’t generate any intrinsic cash flow.

Neither as a commodity - because it is not raw material that can be used in the production of something useful.

Neither as a “good” currency - because of its lack of widespread acceptance, intrinsic volatility and the inefficiency of transactions.

… which would leave Bitcoin at best with the “collectible” tag.

For a wide array of reasons, I respectfully disagree with this standpoint. But it’s a good example of the flexible approach that one needs to take when valuing crypto projects.

The technology and economy being built on chain are still very fluid. A ton of examples come to my mind that form a solid argument for the future utility of Bitcoin within the wider ecosystem.

The most recent developments include the testnet launch of BabylonChain, which aims to use Bitcoin as the security layer for the Internet Of Blockchains, or the emergence of sovereign / EVM-compatible Rollups on Bitcoin via the Roolkit framework.

As I said before, it’s still too early to apply a one-size-fits-all framework : I’m very curious to explore more concrete examples from Damodaran’s material, and feed them back to you over the dMBA channels.

Until then, don’t forget to check out the other tracks for more crypto / VC-related deep-dives ! 🤓

Julien

Who am I ?

🏎 Former F1 engineer.

🏆 15+ years contributing to the success of high performance organizations, on & off-track.

🕵🏻♂️ 5+ years extracting signals from the crypto noise.

📊 On-chain data & crypto analytics specialist.

🧠 Unlocking access to business education with the dMBA.

👼 Open-source angel investing & VC firm building.

🌎 Check my complete profile here !

How can I help ?

Are you a founder or investor, on a mission to make the global financial system more accessible, transparent & positively impactful ? Does this content resonate with you ?

Let’s connect. Besides fundraising, I’d be stoked to support with on-chain data, analytics or any research work specific to crypto (e.g. tokenomics, governance).

Join the dMBA chat lounge :

Download the Substack app by clicking this link or the button below. Substack Chat is now available on both iOS and Android.

Open the app and tap the Chat icon. It looks like two bubbles in the bottom bar, and you’ll see a row for the dMBA lounge inside.

That’s it! Jump into the 1st thread to say hi, and if you have any issues, check out Substack’s FAQ.

⚠️ Disclaimer : the content of this newsletter is for educational & entertainment purpose only. In no situation should it be considered investment, tax or legal advice. The reader is invited to build his/her own opinion about the views expressed, and take appropriate decisions for his/her specific situation or objectives. Digital assets are highly volatile and the risk of capital loss must never be underestimated : do your own research, and only invest what you can afford to lose.

Great take, thank you! Have a great week!