Dear Cerclers,

I simply, truly hope this new edition of 36⭕️° finds all of you safe and well.

If for any reason need to chat, my DM’s are open (no financial advice). I’ve also enabled the chat feature for this Substack, and wanted to remind you that the Town Hall channel is open to all on the Cercle DAO Discord.

Crypto content related to the FTX downfall and its consequences will continue flowing for the foreseeable future. Of course, we all need some time to wrap our heads around the amount of misery and disbelief that keeps emerging from the aftermaths of such an event.

Anything remotely similar in traditional finance would likely unfold over a generation’s time : in crypto, it all happened last week ... And, as is often the case in such circumstances, it's neither easy nor comfortable to take a step back and face the big picture. But we’ll try to have a go at it today.

If you're like me, you've still got this small fire burning deep in your gut - and you may be assessing whether it's a flame worth keeping alive, or if you'll just leave it douse under the ashes of a terrible year.

Our instinct tells us that what just unfolded should never be allowed to happen again. It’s the last wake-up call of a long series about the urgency to let go of YoLo / guru CEO’s, and opaque businesses printing their own multi-billion dollar success out of thin air.

Deep inside, we remain social animals : we strongly rely on the sense of belonging to a tribe, as well as trusting charismatic leaders to show us the way. Our attention is magnetized by these improbable success stories, even after they end up in darkness and opprobrium.

That’s how history rhymes. That’s why there will be other SBF’s & other Madoff’s, other Alameda’s & other Enron’s.

In the meantime, the crypto community is once more challenged to raise its standards, and live up to its core ethos : don’t trust, verify … but first and foremost, isolate and annihilate the nuisance capacity of these kids playing with real money and lives.

It’s taken humanity 20 years to unravel the Internet conundrum, and come up with the idea that a decentralized World Wide Web would be the positive next step of this long evolution. Why is that ? Well, in 1995, we were all like young Obiwan Kenobi unpacking his 1st lightsaber for Christmas !

Now that we’ve (supposedly) grown up, we’ve received crypto : a double-bladed lightsaber, that is. A complex, shiny new toy that can tip us over to the dark side of the Force, if nobody ever reads or updates the f*cking manual.

The time has come for people in crypto to be boring again, at least for a bit ... It’s on us, the anonymous crowd of analysts and researchers, to get our hands dirty and relentlessly pull the unsexy, rational, procedural, data-backed reality out of the oil slick.

Only like this will the industry be able to build & promote comprehensible, resilient business models. Only like this will the black tide dissolve to make space for a crystal clear truth : crypto can and will be a force for good in this world.

Before we come to this point, we’ve got a lot on our plate :

How can we equip crypto users with the consciousness and literacy required to make independent, sovereign financial decisions ?

Where do we need to level up ourselves to understand exactly how the global financial system works, businesses are built and value accrued over the long haul ? What simple, reliable products can we bring to the table, so that this benefits the many instead of a selected elite ?

What metrics or charts can we aggregate to safeguard ourselves from our short-sightedness next time a hot fad comes along ?

As far as this newsletter and these past few weeks are concerned, I have included a few diagrams & excerpts of my recent research below. But, as I have mentioned on Twitter, this is only the beginning : never before was my motivation so high to make a positive impact in this ecosystem.

Whether you're a founder or VC involved in DeFi, and this resonates with you : I'd be stoked to connect. Let's have a quick chat about how I can support with on-chain analysis or other specific research (e.g. tokenomics, governance, community) as well as fundraising prep / due diligence work.

My personal, longer-term objective is to set up an open-source VC firm : I will do my best to share more resources & progress on this in the coming editions. Finally, I will feed all my learnings into Cercle ⭕️ DAO's dMBA at a more granular level, to enrich the program with concrete, real life experience.

Res⭕️urce Center : a few hot links

Let’s stop building for Crypto Twitter, shall we ?

How to educate yourself as an investor …

Diligence on crypto VC’s !

Open Rep⭕️ : a playbook for technical revolutions

Is crypto the most obvious candidate for the next technological revolution, or simply an obvious extension of the age of information and telecommunications, that was kicked off with the 1st micro-processor in the 1970’s ?

This analysis of Carlota Perez’s book “Technical Revolutions and Financial Capital” resonates a lot with the recent events, and the atmosphere currently surrounding in tech - if not the whole world.

Here’s a TL;DR with the bits that I included in one of my Smart Notes :

Perez's argument is that the 4 technological revolutions that proceeded the current Dotcom age followed a similar cycle :

“In particular, the process of installation of each new techno-economic paradigm in society begins with a battle against the power of the old, which is ingrained in the established production structure and embedded in the socio-cultural environment as well as the institutional framework.”

Sounds famliar, uh ?

”While the installation period begins with irruption as new technology emerges in pursuit of real world applications, it eventually transitions into a full-blown frenzy as speculative capital pursues increasingly fantastical commercial applications. Reality finally catches up and the bubble pops.”

More and more interesting …

“With the collapse comes recession - sometimes even depression - bringing financial capital back to reality. This phenomenon, combined with mounting social pressure, creates the conditions for institutional restructuring : many of the social innovations which gradually emerged during the period of installation are then brought together with new regulation in financial and other spheres, to create a favorable context for recoupling and full unfolding of the growth potential.”

While the introduction to “Technological Revolutions and Financial Capital” makes the case that the Dotcom Bubble was a Turning Point in the long process of software eating the world, Perez now seems to think we are still waiting for the Golden Age to fully unfold - with more sectors not yet having delivered their full potential : AI, IoT, 3D, robots - or crypto …

According to the author, yet another bubble popping could be enough to get the party started ... Which makes me really curious to hear how this resonates with you too !

For example, where do you think crypto currently stands in this cycle ? Or do you think Web3 is just an extension towards the Golden Age of information & telecommunications that will also encompass other “emerging” technologies ?

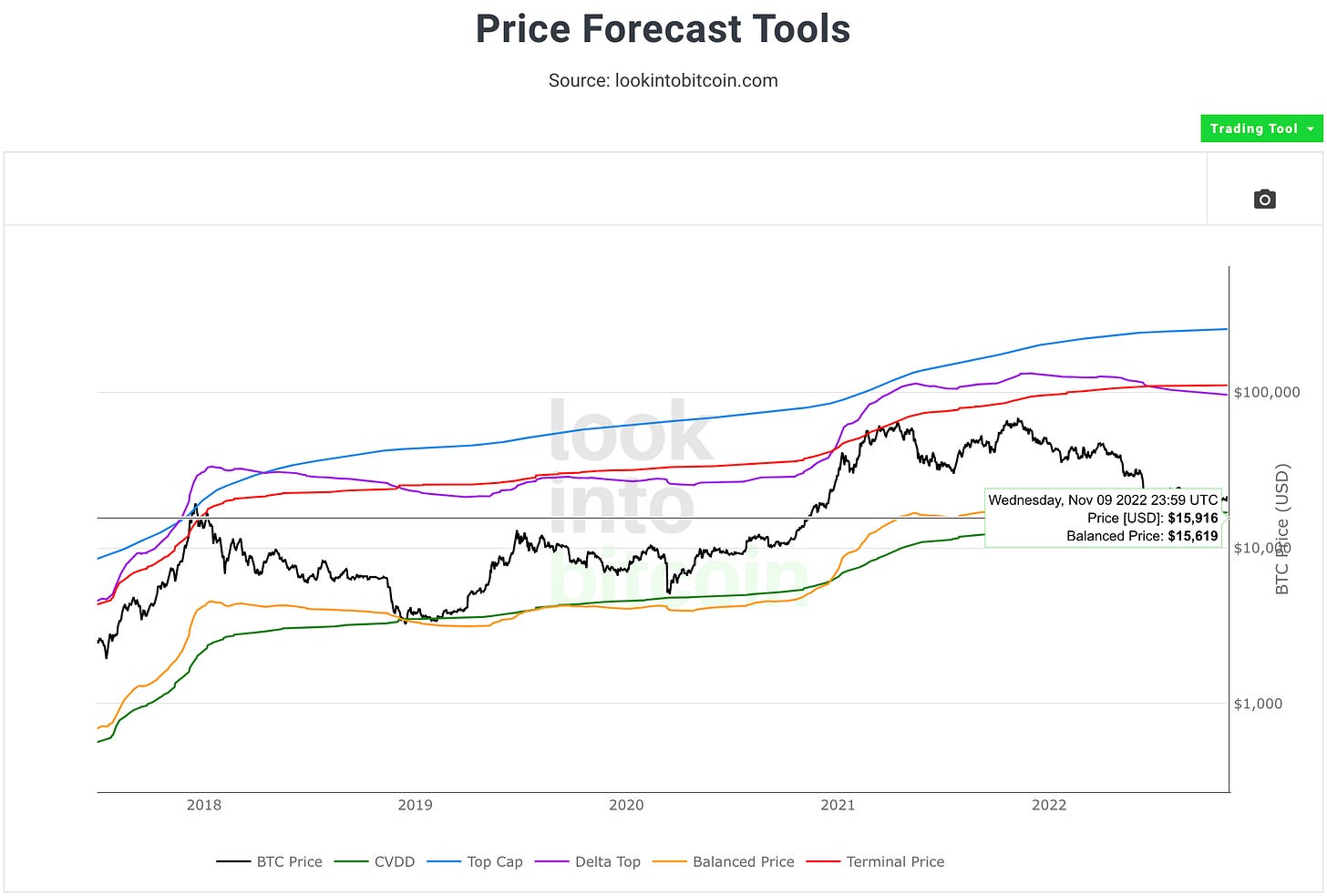

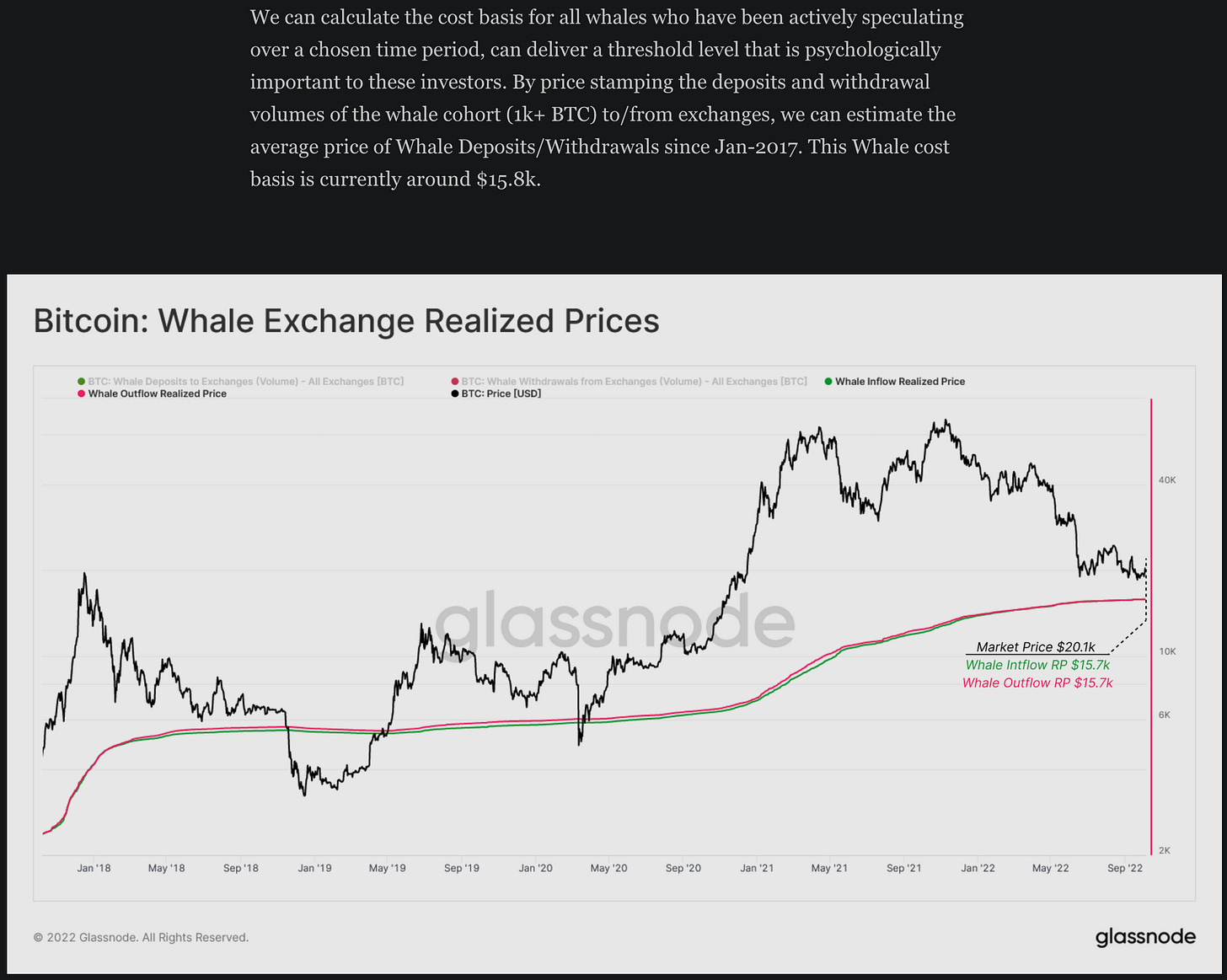

Pl⭕️ts & Odds : what’s next for Bitcoin ?

Official Links :

🌎 Homepage ➡️ https://cercledao.carrd.co/

🐥 Twitter ➡️ https://twitter.com/cercledao

👾 Crew3 Questboard ➡️ https://cercledao.crew3.xyz/questboard

🎮 Discord ➡️ https://discord.com/invite/h7gjSzrWty

💎 Clarity ➡️ https://app.clarity.so/cercledao/join

⚠️ Disclaimer : the content of this newsletter is for educational & entertainment purpose only. In no situation should it be considered investment, tax or legal advice. The reader is invited to build his/her own opinion about the views expressed, and take appropriate decisions for his/her specific situation or objectives. Cryptocurrency is a highly volatile asset class and the risk of capital loss must never be underestimated : do your own research, and only invest what you can afford to lose.